👨🚀Introducing ALGOBLOCKS

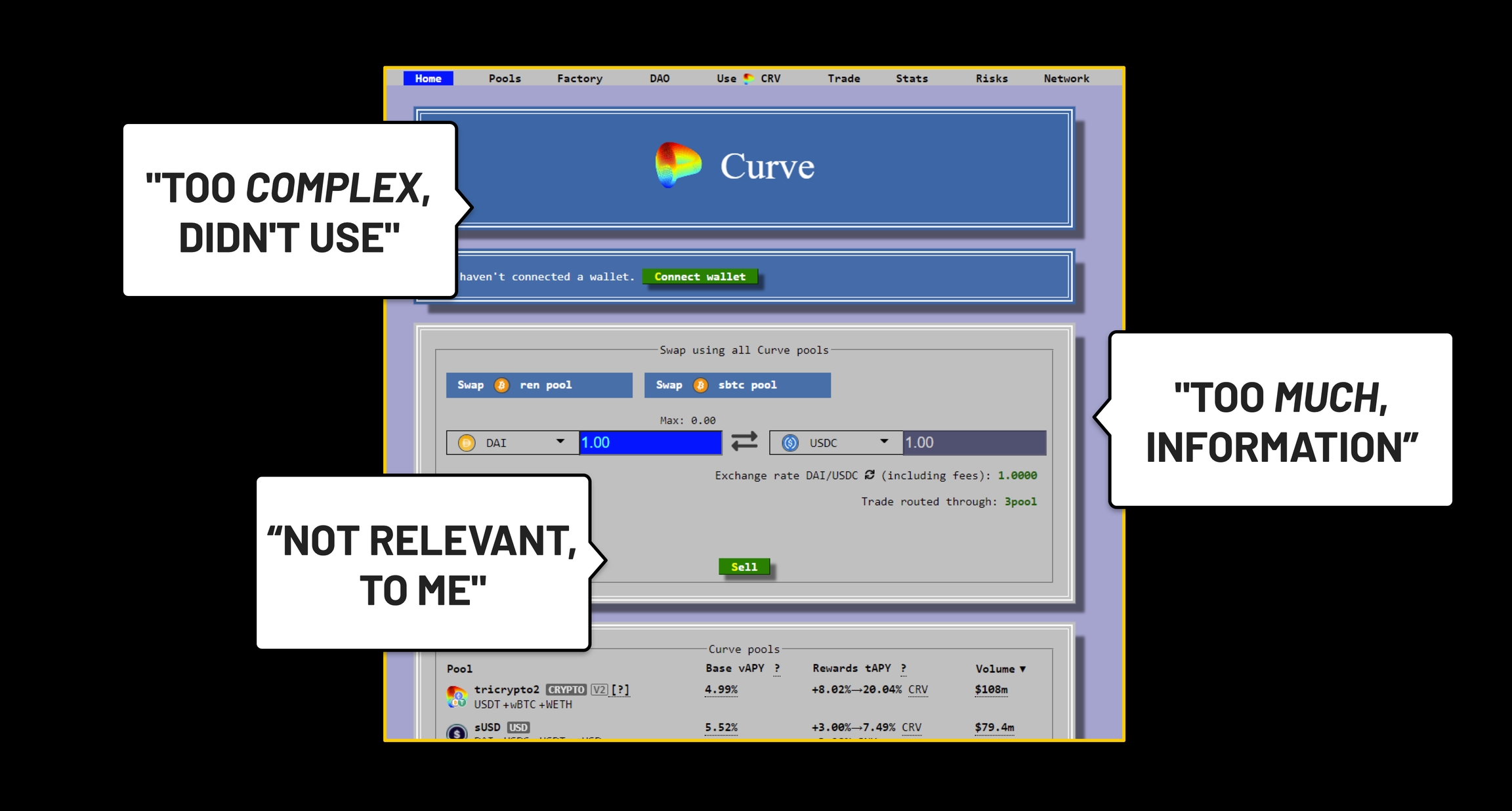

The Pain Point(s) - Too Much, Not Relevant, Too Complex

In recent years distributed ledger technologies have led to a blooming DeFi space and increased disruption of the traditional financial institutions. Part of this disruption is through an increased interest rate of a considerable higher return on the invested virtual assets either through innovations that can only exist within the blockchain realm, such as staking or yield farming or high interest lending to a trustless 3rd party. Too Much

The DeFi ecosystem has grown rapidly and the market is still growing at a monstrous pace of over 9% per year. In other words, users are spoilt for choices and it would be very challenging for them to even know about your product.

Not Relevant

67.0% Bounce Rate - The rate in which users leave your site after the first page. This implies that they scan, dont interact and promptly leave. 2/3 users leave the site immediately because they dont find the DeFi app relevant to them. It is extremely difficult to engage users in DeFi.

Too Complex

Based on our research and discovery, we found that even simple tasks like bridging and staking are intimidating for most crypto users. Currently, most of the products are trying to remove this friction in the DeFi experience through aggregation. Aggregating multiple DeFi products or services doesn't lower the entry barrier or eliminate the need to have the technical knowledge to know how to use them. Our Vision

Algoblocks envisions a personalized DeFi platform where users can access numerous DeFi protocols in one place and have curated recommendations to discover, invest and manage their DeFi products. DeFi actions that were cumbersome and complex would all be streamlined for the user so that the focus for the user would be on discovering and using great DeFi products.

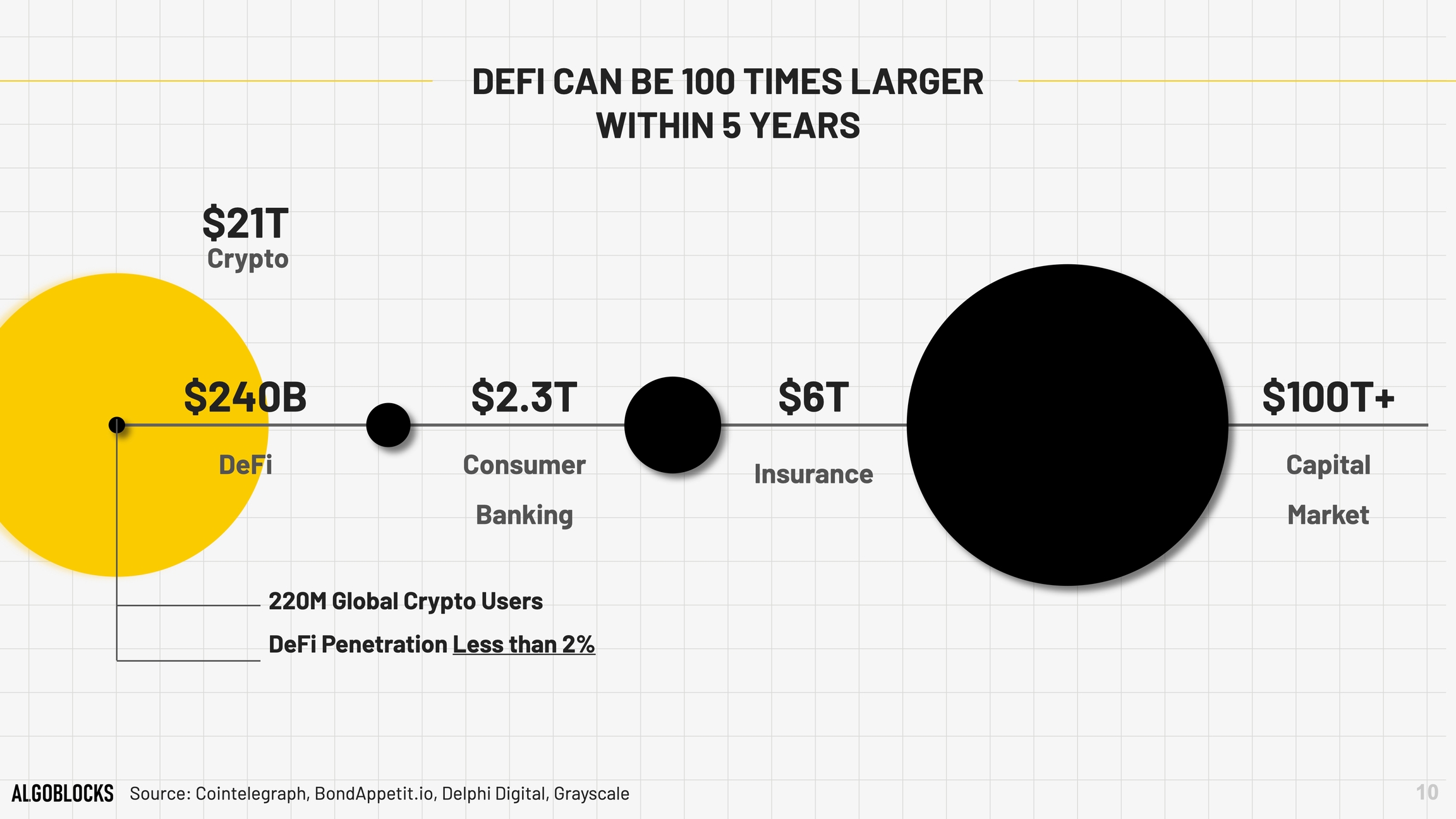

Market Opportunity

The DeFi market has grown exponentially over the years but there is significant potential for the market to grow even further in the next 5 years. Even though the DeFi space offers a universe of different products or services, we observed a low number of users compared to the total number of blockchain users. For example, if we compare the number of users active on the centralized crypto exchanges such as CoinBase or Binance, the numbers are well beyond 50 Million active users; however, the numbers dwell in comparison to around 3 Million users within the DeFi space. According to Graysscale, a leading Digital Assets Fund manager, DeFi can grow 100x within 5 years.

Last updated